There are many examples of how “failure to evolve” has led to the unthinkable fall of once titan companies and entire industry segments. Kodak, Blackberry, Sears, Blockbuster and Polaroid are typically referenced examples. So why is evolution so difficult for some? When these once titan companies were on top, they wanted to keeping growing, right? Or were they simply defending and continuing to deploy only the tactics that got them to their pinnacle, no matter the ultimate result?

If you walked into a Blockbuster Video location in the 90s, you saw a successful business freight train that looked like it would never stop. There are many factors why Blockbuster is gone today (except for one relic in Bend, OR), but “failure to evolve” was certainly a significant contributor. In 2000, Blockbuster had an opportunity to purchase Netflix for $50M. Blockbuster actually identified the trends like Netflix’s original business model (mail order DVDs with no late fees) and later streaming, but they acted too late or in some instances chose not to act at all.

What can we learn from these historical massive missteps? I believe dealers and their support community must continuously improve both their sales and service processes. However, that’s an expectation. A fundamental and massive problem exists in the vast vacancy between sales and service that’s not being adequately addressed, where almost every dealer operates sales and service like two separate companies under one dealer roof. Many times sales and service in the same dealership don’t even like each other. This architectural problem creates a significant self-inflicted limitation in the dealer-customer ownership journey, where many customers feel like the transaction and therefore the relationship have concluded with the purchase of the vehicle.

Ask yourself, is the auto industry’s mission to only sell a vehicle and maybe a couple of F&I products or to also earn a recurring customer? Auto retail throws the kitchen sink at customer acquisition which typically leads directly to awkward silence after the vehicle sale. Even with the significant advancement of digital retailing, the associated digital experience abruptly ends with (or before) the vehicle sale…further substantiating to the customer the transaction and relationship have concluded.

I’ve seen many misguided attempts to end the silence between sales and service, with phone solicitations, junk email and random text messages (all are random BTW and are NOT desired by your customers). How about sending a post card to your customers on their birthday? Ridiculous. Oil change coupon in the postal mail or another random email? Equally out-of-touch with reality. Maybe they’ll intuitively revisit your website at some point? A better way exists.

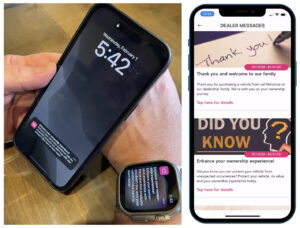

Dealer Messaging with push notifications (Your Dealer Experience by Strategic DX)

The naysayers rationalize everything is OK, “Look how busy we are. We’re resilient in the face of adversity.” At one point Blockbuster said the same thing.

Keep refining the sales process, of course. Keep refining the service process, definitely. Both are expected. Bridge the gap between sales and service to propel Your Dealer Experience beyond the one-time transaction, you decide if that matters to your business and our industry. Leadership and process are required. The desired process is already available.

How about the critical financial work center of F&I? Pat Ryan and Associates created F&I in the late 60s and it’s remained relatively unchanged since then in both its sales and service practices. If F&I is 1. critically valuable to a dealers’ financial success, 2. if it’s valuable to the support community’s financial success (the very important F&I administrators and agents that make F&I possible), 3. if it’s valuable to enhancing/protecting the customers’ ownership experience and 4. if it’s valuable to the customers’ loyalty back to their selling dealer, (if all of that’s true) why does our industry and it’s support community leave all that revenue and relationship value to the micro moment of the F&I menu presentation alone?

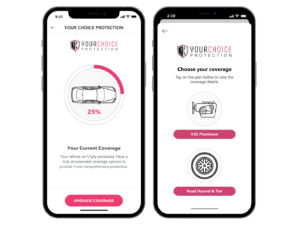

How many customers leave the dealership (after an exhausting car buying experience) not purchasing all the F&I products they would have otherwise purchased (or no F&I products at all) because they simply couldn’t make an informed decision in that micro moment? What about engagement strain of remote vehicle purchases? This logical post sales tactic isn’t creating additional risk, it’s simply capturing the missed opportunities directly after the vehicle sale (within days/weeks). Keep your current F&I menu presentation but shouldn’t the customer (and service advisor) have intuitive access to all their purchased F&I products (even if they’re powered by multiple administrators) on their smartphone (or desktop) and by organic extension also be able to see all the F&I products still available to them after the vehicle purchase (with the ability to buy or finance them on their smart device)? It’s unbelievable this self-inflicted revenue and relationship limitation still exists…especially when a proven solution is available to solve it today.

F&I products still available after the vehicle sale, personalized to each customer (automatically removing already purchased products, compliance restricted products and honoring the administrators’ eligibility requirements).

F&I service is equally archaic, in most instances. 1-800 numbers (different for each F&I administrator), phone queues with CALL HOLD WAIT TIMES (of any length) and manual claim processing litter today’s F&I service environment. It’s 2023 isn’t it? Some administrators have made the small step to an online (fill-in-all-the-blanks) claim form that leads to a phone call anyway or an app that only works with that single administrator or only certain F&I products, giving the service advisor one more thing to do in a reality where most dealers have multiple administrators fueling their F&I environment. Shouldn’t the service advisor (and customer where permitted by the administrator) be able to fully process digital claim service in one unified application (even when multiple administrators exist), where capturing the missed F&I revenue after the vehicle sale is also accessible? …with no change to the F&I administrators’ internal admin platform necessary to deploy? The solution exists and is ready to engage today. Are you ready to evolve? If not, remember someone else already is.

Are you part of the solution or the disconnected from reality problem that is holding our industry back from it’s fullest potential? You don’t have to say it, your customers experience it and will make decisions based on it.

Take it one step further. Most F&I administrators are spending the most amount of money processing F&I claims the least desirable way. Staffing shortages and remote work from home have exacerbated an operational inefficiency that’s been there for a long time. Quality people definitely matter, but so does intelligent process too. In that same digital environment where claims can be fully managed and missed F&I sales are captured after the vehicle sale, shouldn’t the F&I administrator be able to apply their own digital rules so claims can be automated where possible, when all the claim rules are digitally satisfied to their specifications? This also exists today. …or is answering the phone, manually entering claim data and touching every claim multiple times the best use of everyones’ time/expertise including the claims team, service advisors and customers? Hint: the former does not negatively impact claim frequency/severity…it only impacts operational efficiencies gained.

The divided dealership house extends to F&I too. Variable ops leverages a digital platform (a menu system) to unify the sales process of multiple F&I providers’ products in one presentation during the micro moment of the vehicle sale. Keep it. What happens after the vehicle sale to the customer and fixed ops? …F&I is completely disconnected. Did you know most service advisors are not aware of what F&I products their own dealer sold their customers? Is that OK in a reality where a world class employee and customer experience are desired? How can a service advisor sell an F&I product to a customer that they don’t already have if the service advisor doesn’t know what the customer already purchased via multiple F&I administrators? Self inflected again. 100% solvable now!

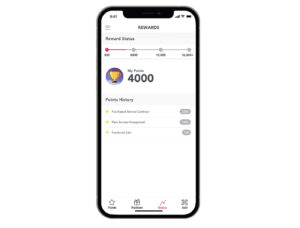

Incentivize customer loyalty with a digital rewards program in the same unified dealer branded Your Dealer Experience app.

There are solution providers (vendors) taking short cuts, no surprise. I’ll challenge this topic again, is our great industry just trying to sell something one-time or also earning a recurring customer? Isn’t it time to move forward by “Connecting the Disconnected” ownership experience problem? Could you imagine in 2023 being able to purchase a flight on your United app but you couldn’t board the plane, change your seat or access your rewards in the same application? Ridiculous right? Deliver digital lifecycle beyond digital retailing and eliminate the ownership experience fragmentation with Strategic DX – Your Dealer Experience.